The Ultimate Guide To Pacific Prime

The Ultimate Guide To Pacific Prime

Blog Article

Rumored Buzz on Pacific Prime

Table of ContentsThe Only Guide for Pacific PrimeSome Ideas on Pacific Prime You Should KnowPacific Prime Fundamentals ExplainedSome Ideas on Pacific Prime You Need To KnowWhat Does Pacific Prime Mean?

Insurance is a contract, represented by a plan, in which an insurance policy holder gets monetary security or repayment against losses from an insurer. The firm swimming pools customers' risks to pay more budget friendly for the guaranteed. Many people have some insurance coverage: for their vehicle, their residence, their health care, or their life.Insurance additionally aids cover prices linked with liability (lawful responsibility) for damages or injury caused to a 3rd party. Insurance is an agreement (plan) in which an insurance firm compensates one more versus losses from particular contingencies or perils.

Investopedia/ Daniel Fishel Several insurance plan kinds are available, and practically any type of specific or organization can find an insurance business ready to insure themfor a rate. Most people in the United States have at least one of these kinds of insurance policy, and vehicle insurance is required by state legislation.

More About Pacific Prime

So finding the price that is appropriate for you needs some legwork. The policy limitation is the maximum amount an insurance company will certainly pay for a covered loss under a policy. Maximums might be set per duration (e.g., annual or plan term), per loss or injury, or over the life of the policy, likewise referred to as the life time maximum.

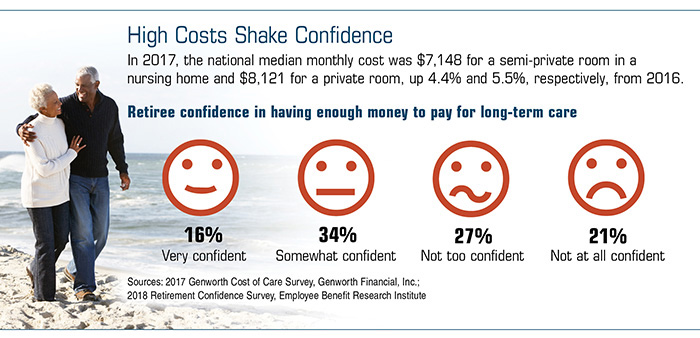

There are numerous various kinds of insurance coverage. Health and wellness insurance policy aids covers routine and emergency situation medical treatment expenses, commonly with the option to add vision and oral solutions individually.

Several preventive solutions may be covered for complimentary before these are met. Medical insurance might be purchased from an insurance provider, an insurance coverage agent, the federal Medical insurance Marketplace, given by an employer, or government Medicare and Medicaid insurance coverage. The federal government no longer needs Americans to have health insurance policy, but in some states, such as The golden state, you might pay a tax obligation penalty if you do not have insurance.

The 6-Second Trick For Pacific Prime

Rather than paying of pocket for automobile crashes and damages, people pay yearly costs to an auto insurance provider. The firm then pays all or the majority of the protected expenses connected with a vehicle crash or various other car damage. If you have a leased automobile or obtained money to get an automobile, your loan provider or leasing car dealership will likely require you to carry auto insurance coverage.

A life insurance coverage plan assurances that the insurer pays an amount of money to your recipients (such as a spouse or kids) if you die. In exchange, you pay premiums throughout your lifetime. There are 2 main kinds of life insurance. Term life insurance policy covers you for a certain duration, such as 10 to twenty years.

Insurance is a method to handle your financial dangers. When you acquire insurance coverage, you purchase protection versus unanticipated monetary losses.

The 45-Second Trick For Pacific Prime

There are several insurance coverage policy kinds, some of the most common are life, health and wellness, home owners, and car. The ideal type of insurance for you will certainly depend on your goals and monetary situation.

Have you ever before had a minute while taking a look at your insurance plan or purchasing for insurance when you've believed, "What is insurance? And do I actually need it?" You're not alone. Insurance policy can be a mysterious and perplexing point. Just how does insurance coverage job? What are the benefits of insurance coverage? And just how do you locate the finest insurance policy for you? These are common concerns, and thankfully, there are some easy-to-understand answers for them.

Suffering a loss without insurance policy can put you in a difficult financial circumstance. Insurance policy is a crucial economic device.

Examine This Report on Pacific Prime

And in Full Article some instances, like automobile insurance policy and workers' settlement, you might be called for by regulation to have insurance in order to safeguard others - group insurance plans. Learn more about ourInsurance options Insurance is essentially an enormous nest egg shared by lots of people (called insurance policy holders) and managed by an insurance coverage service provider. The insurance coverage company uses cash gathered (called costs) from its insurance holders and other financial investments to pay for its procedures and to fulfill its promise to insurance holders when they sue

Report this page